We can observe how, over the last 5 years, there was a considerable relationship between storage levels and prices. Now, a natural way of building the model to estimate prices would be to define a set X of predictive variables to estimate a target Y, which could be futures prices or changes in prices. However, a practical approach for our current project could also be modelling the relationship between storage levels and prices alone befor considering other variables. This could be useful as it woule provide the following:Reliability: By adjusting prices for storage, we can convert the front month strip to a stationary time series, which allows us to build a more reliable model.

Reliability: By adjusting prices for storage, we can convert the front month strip to a stationary time series, which allows us to build a more reliable model.

Interpretability: If we build a regression model using

Understanding the Impact of Fundamentals on U.S. Lower 48 Gas Futures

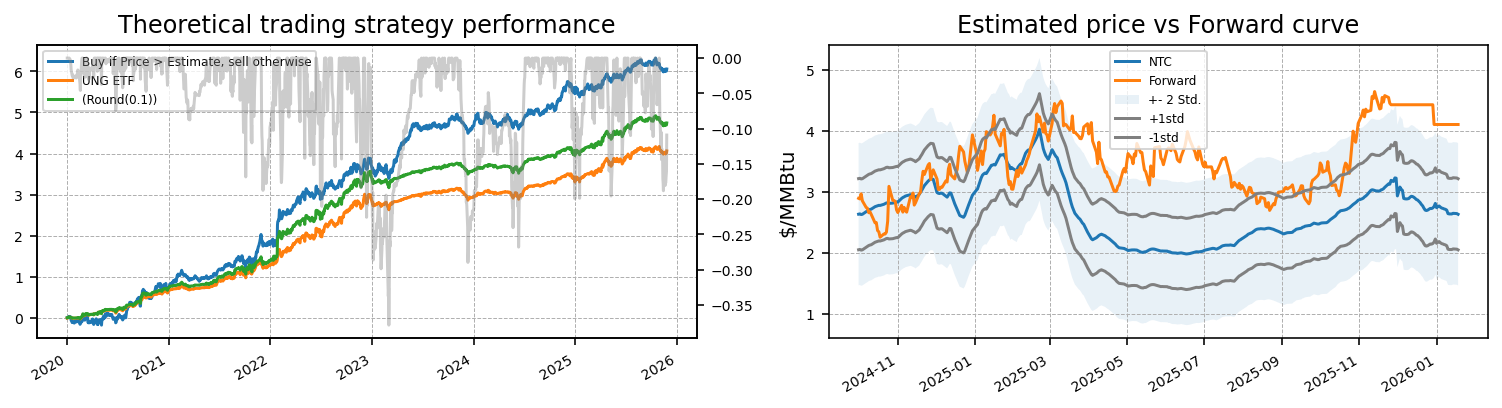

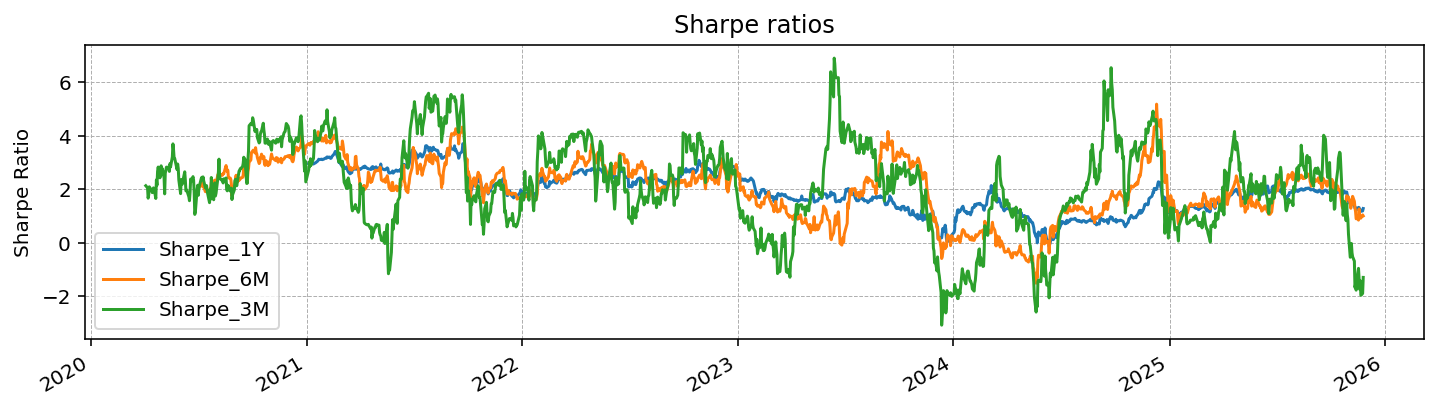

The following analysis proposes an approach to estimate price behavior in Henry Hub futures markets. First, we assess how fundamentals separately impact prices. Then we seek to find a useful statistical methodology to capture pricing dynamics, demonstrating how the bias - variance tradeoff impacts the performance of a systematic trading strategy and shows that not always the most accurate model will yield the optimal returns.

Index:

1) Fundamental drivers

Storage and Prices

Weather & Short-term Injection forecasts

LNG & Shifting dynamics

Other analyzed drivers

2) Statistical model

3) Systematic Strategy

Fundamental drivers

Initially, a set of fundamental variables was analyzed with the hypothesis that they all impacted prices in one way or the other. Among the assessed variables, we included the following. Storage levels, Weather forecasts, Injection profiles, the evolution of LNG exports, standalone demand variables (Rescomm, Industrial or Power Burns), days to cover, and storage level release surprises.

Storage and Prices

In U.S. natural gas, storage is a core signal. The market is constantly trying to price where stocks will land at the seasonal endpoints—March 31 and October 31. Traders who can forecast those EOS levels more accurately gain a meaningful edge, because storage expectations are what move both outright prices and the curve. When building a systematic trading signal, there are various ways to account for storage. Initially, we could think of using the estimated EOS storage level at time t. For example, if we are trying to model prices on December 1st, we would use as a reference the estimated EOS storage level on March 31st of the subsequent year. However, this would require either enough data to track what the market’s estimate for EOS was at a given point in time in the past, or a robust backtesting framework that allowed you to recreate the conditions in the past and recreate historical forecasts without any look-ahead bias.

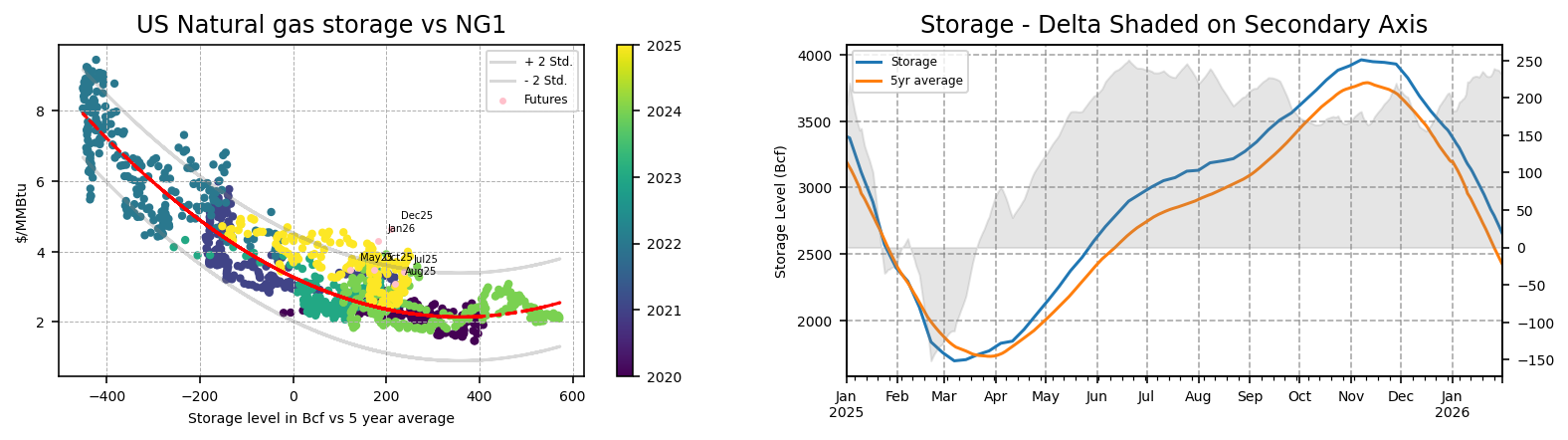

Therefore, while focusing on near-term fundamentals can narrow a broader context, the clarity and tractability of short-term signals can make them easier to handle and analyze. This raises the methodological question of how storage should be expressed to capture its market impact. A common approach is to express inventories as a delta versus the 5-year average to seasonally standardize the data. Using this transformation, we can cleanly assess how storage deviations have mapped to front-month price behavior since 2020.

Escrivbe algo

Weather & Short-term Injection forecasts

A key driver of storage levels is weather, as it impacts natural gas demand to heat spaces during winter, generate power to cool spaces during summer and for industrial manufacturing. Therefore, weather forecasts have a big effect on prices, especially during Winter.

Escrivbe algo

LNG & Shifting dynamics

We can observe how the dots for 2025 (Yellow) have stayed consistently above the regressed polynomial. This suggests there could be a factor that might be driving prices higher attributable to either the market consistently overestimating futures prices or a fundamental driver that suggests that such a relationship is shifting upward.

Escrivbe algo

Other analyzed drivers

Some other variables and market events were taken into consideration as part of the analysis but, while it is evident that they affect market prices, failed to provide a menaningful or concistent signal to benefit our model:

Production and curtailment announcements: Production alone is one of the main drivers of cash and futures prices, and there are regimes in which it is the most relevant factor for price action. However, it resulted difficult adding production as a standalone variable to our model. This is because on one hand, it not always matters, ond the other hand sometime what matters is current production while other times the expected production. and sometimes…

EIA Storage releases:

Regional Storage:

Cash Prices:

Escrivbe algo

Model parameters

A key driver of storage levels is weather, as it impacts natural gas demand to heat spaces during winter, generate power to cool spaces during summer and for industrial manufacturing. Therefore, weather forecasts have a big effect on prices, especially during Winter.

Escrivbe algo

Systematic trading strategy

A key driver of storage levels is weather, as it impacts natural gas demand to heat spaces during winter, generate power to cool spaces during summer and for industrial manufacturing. Therefore, weather forecasts have a big effect on prices, especially during Winter.